As the economy gets tougher, many are looking for ways to weather this difficult financial storm. While the outlook for offices, retail, hotel and apartments isn’t looking very promising due to rising interest rates, construction companies might be seen as a safe haven for investors as the rocky economic situation worsens.

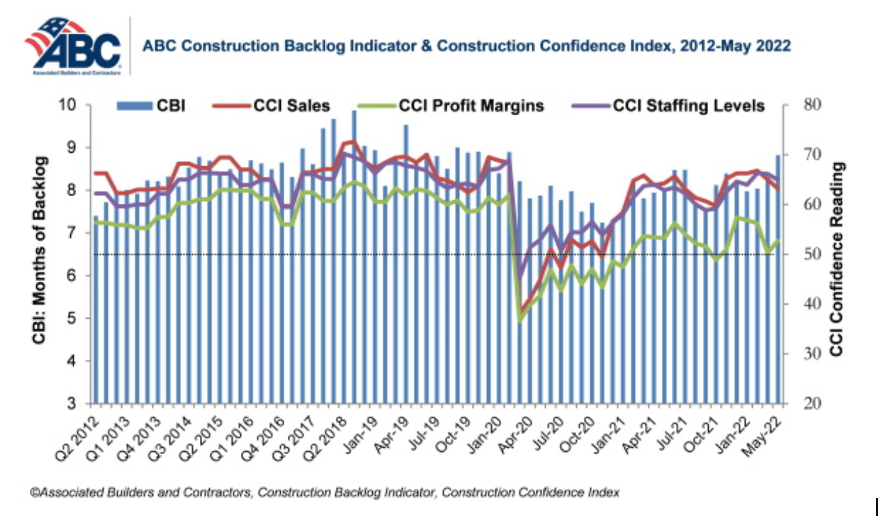

There may be for a few key reasons why some experts are remaining optimistic when they study nonresidential construction stocks. Nonresidential construction projects are currently armed with strong backlogs and fuller infrastructure funding. Not to mention they have an abundance of future prospects and new future projects worth billions.

“It is simply remarkable that contractors continue to add to backlog amidst global strife, rising materials prices and ubiquitous labor force challenges,” said Anirban Basu, Chief Economist for the Associated Builders and Contractors. “Backlog is up in every segment over the past year, including in the somewhat shaky commercial category. The largest increase in backlog has been registered in the industrial segment. More American companies are committing to place additional supply chain capacity in the United States, with Intel and Ford representing particularly recent and noteworthy examples.”

While this is some positive news, Basu also warns that there will be some challenges. “For contractors, the challenge will continue to be the cost of delivering construction services,” said Basu. He continues, “The risk of severe increases in costs and substantial delays in delivery remains elevated given the volatility in input prices, the propensity of the labor force to shift jobs in large numbers and equipment shortages and delays. This ABC survey indicates that the proportion of contractors who expect that profit margins will expand over the next six months is declining, a reflection of lingering, worsening supply chain challenges.”

While we face uncertain economic challenges globally and as a country, many are rightfully looking to the future of nonresidential construction with hope and optimism. We here at RFW Construction Group are privileged and proud to be part of an industry that helps construct buildings that are part of the financial fabric of our nation. We hope and believe that in the days to come we can continue our track record of quality building projects even through the current challenges that experts predict to come our way.

Sources for article:

https://www.constructiondive.com/news/commercial-construction-bear-market-good-stocks/625516/https://www.abc.org/News-Media/News-Releases/entryid/1