Since the beginning of the pandemic construction firms have been struggling with skyrocketing prices, constantly extended wait times for products and a lack of materials. Many wonder how long these issues can continue and what construction companies can do to stay afloat in these turbulent times. Thankfully it now seems like a tiny bit of good news is peeking over the horizon when it comes to supply chain issues for much needed construction materials.

“We have seen measures of supplier performance, delivery times, backlogs and shortages are showing some improvement,” said Jay Pendergrass, director of supply chain management and equipment at Gilbane, in his latest Market Conditions Report for the second half of 2022. He continued, “As we move into the back half of 2022, tighter financial markets, slower growth and a continued improvement of supply bottlenecks could lead to a further retreat in commodity prices and an easing in goods price inflation for many equipment and materials. The rate of increase for commodities is slowing and may be peaking in some commodities as we move to the back half of 2022.”

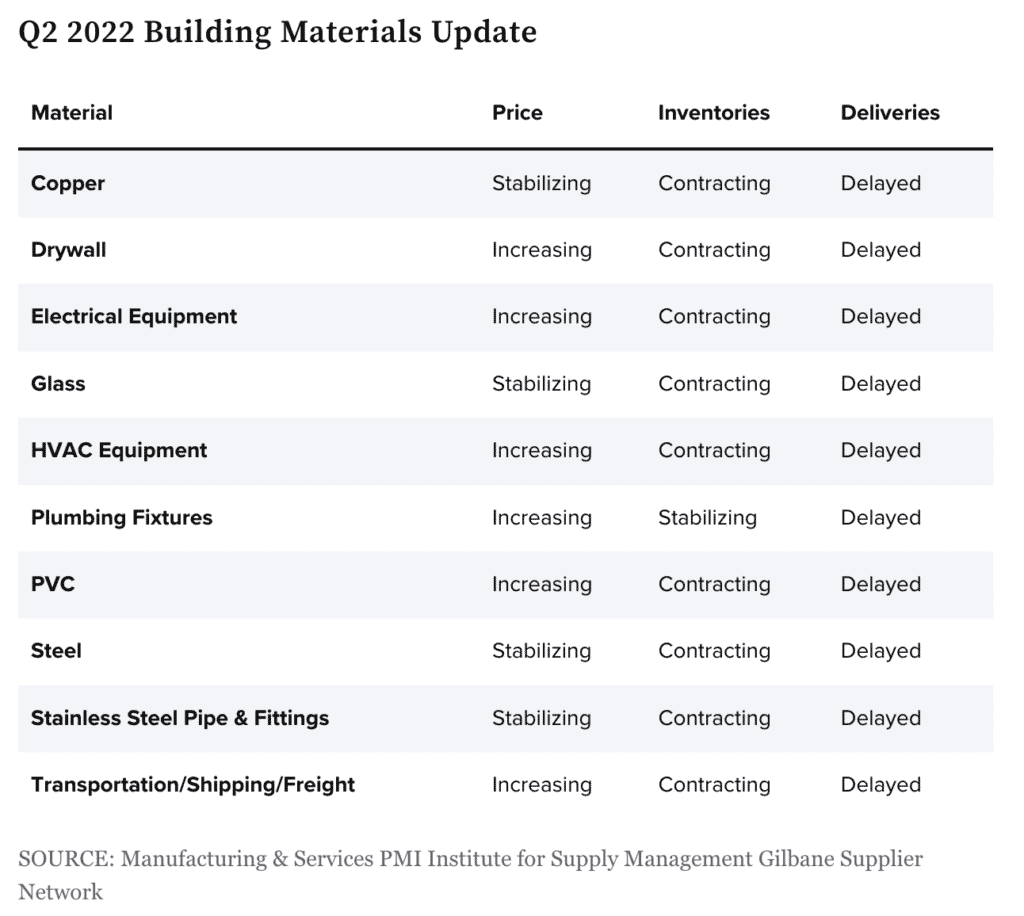

While there is still a long way to go with meeting demands for building materials and seeing solid and long-term improvement along with better delivery times, experiencing less backlogs and fewer shortages is like music to the ears of everyone in the construction industry. We are also seeing prices for some essential items starting to stabilize. The chart below thankfully shows some stabilizing in pricing for materials such as glass, steel and copper which are essential elements that many have been sorely lacking for the last few years. This issue has been a major source of turmoil for businesses, so any improvement is obviously welcome.

Want some more positive news? The Federal Reserve has also promised to raise interest rates. Why could that be a positive? According to Brian O’Connell, a contributor for Forbes Advisor, raised interest rates can mean that “When the Fed[eral Reserve] raises the federal funds target rate, the goal is to increase the cost of credit throughout the economy. Higher interest rates make loans more expensive for both businesses and consumers, and everyone ends up spending more on interest payments. Those who can’t or don’t want to afford the higher payments postpone projects that involve financing. It simultaneously encourages people to save money to earn higher interest payments. This reduces the supply of money in circulation, which tends to lower inflation and moderate economic activity—a.k.a. cool off the economy.” So, here’s hoping for lower inflation and some economic improvement.

Of course, only time will tell what the future holds for the second half of 2022 and the new year, however, we are choosing to keep a positive outlook as we keep an eye on the building materials supply chain and sincerely hope for the best.

Photo credit: Pixabay from Pexels.com

Source material: https://bit.ly/3OuY5Qt